The C Corp or S Corp decision can have a major consequence on the taxes, growth prospects, and flexibility of ownership of your business. In the case of small to mid-sized U.S. companies, the choice of corporate structure is not a mere legal procedure, but it has an impact on taxation, investment prospects, and future scalability.

Being aware of the differences in the very beginning may save time, money, and legal issues that may appear in the future. In this article, we will break down what is a C Corp vs S Corp, exploring their structures, tax implications, and key benefits, so you can make an informed decision that aligns with your business goals.

What Is a C Corporation?

A C Corporation, also known as a C Corp, is a legal person and is not an individual. This type offers the benefit of limited liability, i.e. personal assets of the shareholders are not usually at risk of business liabilities or legal problems. Being a separate entity, a C Corp is taxed separately from its owners and this means that it is liable to corporate income tax on its earnings.

The second important feature of a C Corp is the existence of double taxation. The corporation is subject to corporate level tax on its earnings and any dividends paid to shareholders is taxed once more on an individual tax filing. Nevertheless, C Corps provide a great deal of flexibility in ownership. They are able to have an unlimited number of shareholders including foreign investors and may issue a variety of classes of stock which is desirable in raising capital.

C Corporations are also very appropriate in cases where a business is intending to go public or where a business needs a lot of venture capital. Their structure facilitates growth, investment and intricate ownership structure which suits companies that have long term expansion plans.

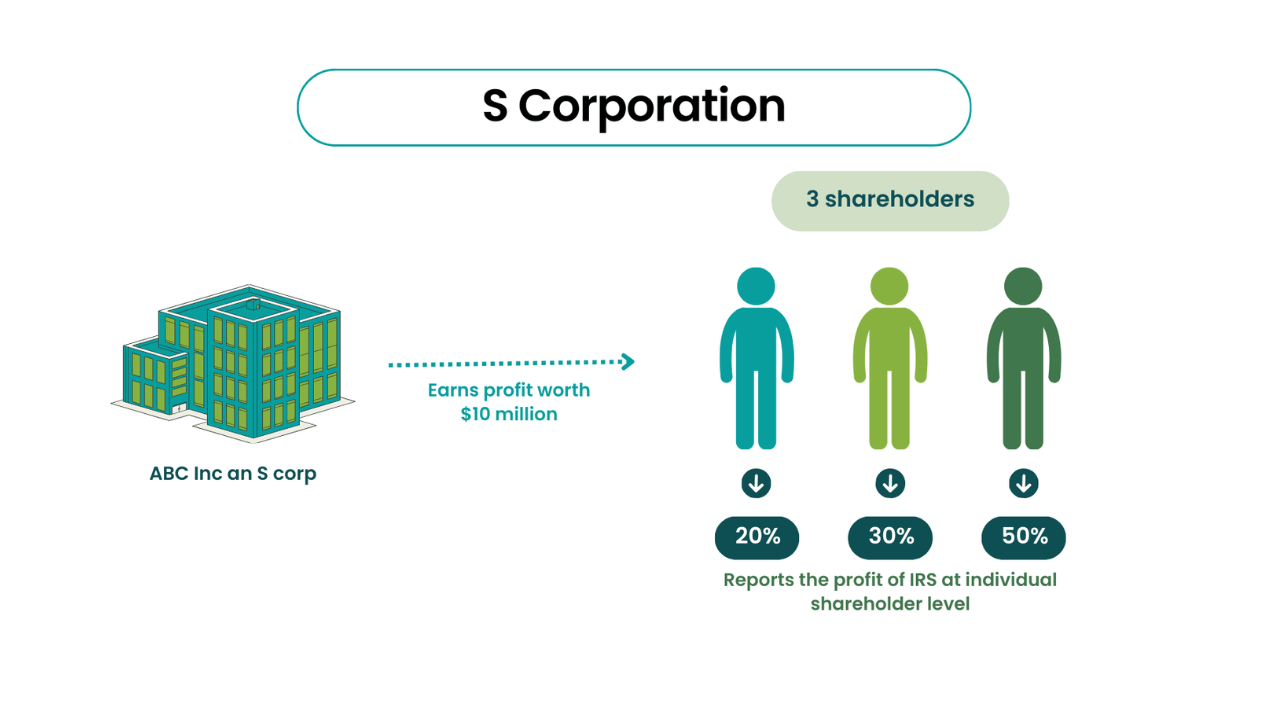

What Is an S Corporation?

The S Corporation or S Corp is a special taxation designation that enables the income, deductions, and credits of a corporation to be directly transferred to its shareholders. This type of structure eliminates the problem of double-taxation that C Corporations have, i.e. the business itself does not pay federal income tax. Rather, the shareholders declare their share of income and losses on their personal income tax filings, which can provide a substantial tax deduction to qualifying businesses.

There are ownership limitations of S Corps. They are restricted to 100 shareholders, and they should all be U.S citizens or residents. Also, S Corps are limited to issue a single type of stock, which does not offer as much flexibility in ownership structure as C Corps. In spite of these drawbacks, this structure preserves the limited liability of a corporation, which ensures that personal assets of owners are not subject to business liabilities and debts.

The S Corporations are also especially favorable to small and medium-sized companies that need to be tax-efficient and easy to operate. The S Corp allows business owners to lower their tax liability and simultaneously enjoy protection of their liabilities whilst maintaining simple administration.

Key Differences Between C Corps and S Corps

In the context of What is a C Corp vs S Corp, it is important to understand the differences between the two so that you could match your business structure with your objectives. This is a summary of the major differences:

1. Taxation

C Corporation: This is subject to double taxation. The corporation is taxed at the corporate level on its profits and the shareholders are taxed on the dividends paid to them.

S Corporation: Provides pass-through taxation. The company does not actually pay federal income tax but rather the shareholders receive the income and losses, which they report on their individual tax returns, eliminating the concept of paying tax twice.

2. Shareholder Limitations

C Corporation: There is no restriction on the number of shareholders and this means that it can have a wider ownership.

S Corporation: It has a limit of 100 shareholders and the shareholders must be U.S. citizens or residents. This limit may affect the capacity of capital raising and diversification of ownership.

3. Stock Options

C Corporation: The corporation may have more than one type of stock, such as preferred and common, which allows the corporation to have more flexibility in how it organizes ownership and attracts investors.

S Corporation: It is possible to issue only one type of stock, which can be a disadvantage in the flexibility of the ownership structure and attractiveness to some investors.

4. Eligibility Criteria

C Corporation: There are no specific eligibility requirements; a C Corp may be any corporation by default.

S Corporation: There are certain requirements, such as: must be a domestic corporation, not more than 100 shareholders, and only allowable shareholders (e.g., individuals, some trusts, and estates).

Read Also: How to control negative thoughts and build the positive thinking

Which Structure Is Right for Your Business?

The decision to adopt a C Corp or S Corp depends on the size of your business, future growth and financing requirements. C Corps are suited to those business ventures that need to expand substantially, venture capital, or go public because they provide unlimited shareholders and various classes of stock. On the other hand, S Corps are appropriate to small businesses that want tax efficiency and simplicity, and pass-through taxation and fewer regulations.

It is important to discuss the best structure with your tax advisor or legal professional to ensure that you have the best structure in your case. They are able to give specific recommendations based on the unique conditions of your business.

To continue with, read about the U.S. Small Business Administration resources on selecting a business structure. It is important to keep in mind that the choice of the structure is a critical move that may define the success of your business.

Final Word

Understanding “What is a C Corp vs S Corp” is essential for making informed decisions about your business structure. They all have different benefits and drawbacks in terms of taxation, ownership and expansion. The selection of the appropriate structure is determined by the size of your company, your funding requirements and the long-term objectives. When you carefully consider these factors, you will be able to choose the corporate form that will best fit your business goals.

Read More: NCP Leader Akhtar Attacked with Eggs, Harassed by AL Activists in New York